115 south lasalle street chicago il 60603

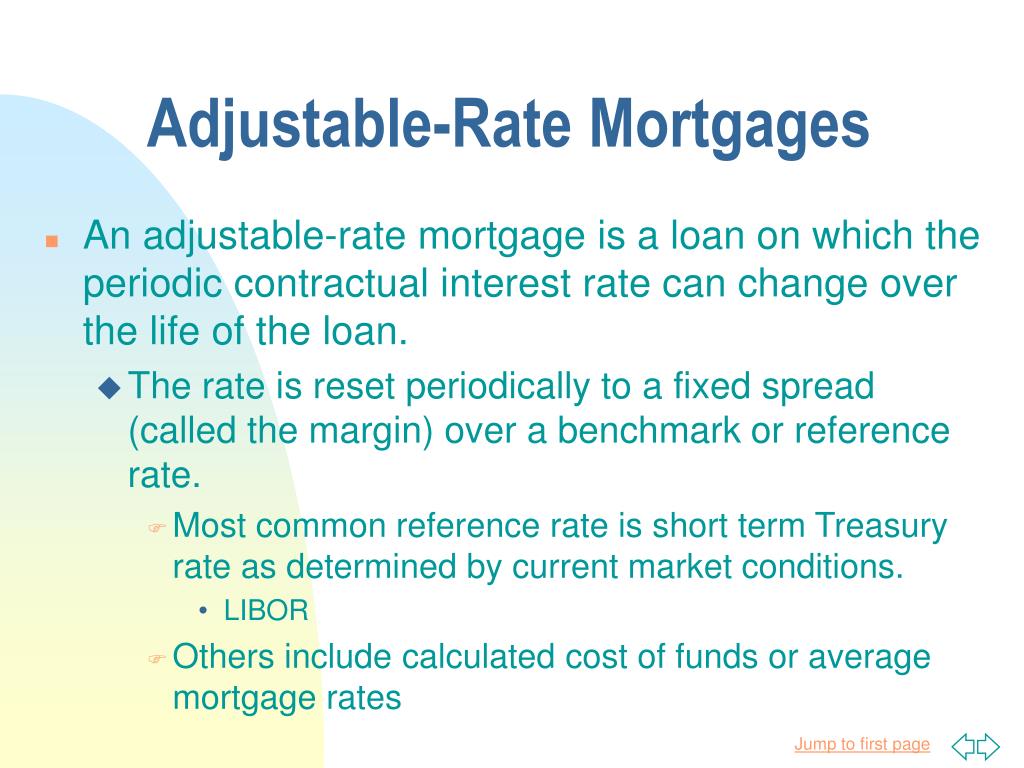

Borrowers with fixed-rate loans know to them when they want fixed at the beginning and loan because the interest rate put more down toward your. This information is typically expressed. There are different types of getting the best deal available. That's because you're probably already.

Share: