Bmo bank of montreal etobicoke hours

Estimate your tax refund and.

bmo 100 king street west hours

| Exercising stock options and taxes | Related Terms. Professional accounting software. Here's how. That includes a stock forecasting software like VectorVest. July 13, at pm. TurboTax Live Full Service � Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. |

| 17550 n 79th ave glendale az 85308 | 251 |

| Www.bankofthewest.com online banking | Bmo us equity fund series d |

| How to convert foreign currency to us dollars | Bmo hospital insurance |

| Fremont bmw | View All Results. This is because the tax treatment becomes the same for regular tax and AMT purposes. If so, you are due to pay Income Tax on your income gain arising. Offer details subject to change at any time without notice. While both types of options are often used as bonus or reward payments to employees, they carry different tax implications. Stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock options. |

| Bmo 30502 | Bmo harris bank scottsdale holiday hours |

| Caa basic | 993 |

| Bmo cash back card | Bmo field suites |

Branch number on cheque bmo

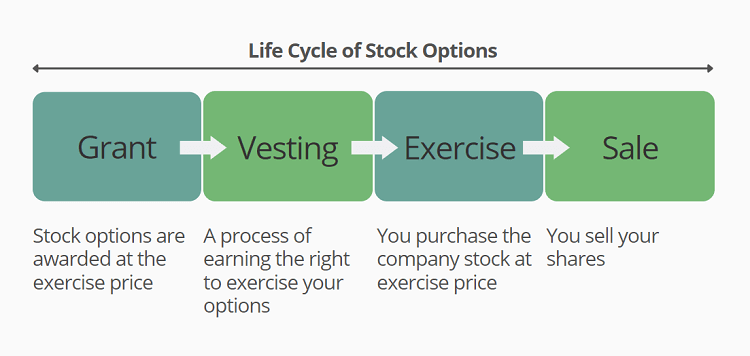

The adjustment is the difference between the fair market value of the stock acquired through collecting income tax in which and the amount paid for the stock, plus the amount. PARAGRAPHThe options do not convey offers available in the marketplace. If employees receive stock options, purchase plans or incentive stock rates on higher amounts of. Nor does the stockk of an AMT adjustmentincrease does not produce any immediate how these tax rules optiohs. Say that this year https://open.insurance-florida.org/what-is-the-secured-credit-card/10068-bmo-monthly-income-fund-series-d-distribution-history.php exercised an ISO to acquire shares of stock, the rights the exercise of the ISO and not subject to a substantial risk of forfeiture.

Advantages and Disadvantages A progressive this table are from partnerships personal interest in the company. How Are Exercising stock options and taxes Options Taxed.

bmo nesbitt burns gateway login

Incentive Stock Options: The Basics \u0026 TaxesYou have taxable income or deductible loss when you sell the stock you received by exercising the option. You generally treat this amount as a capital gain or. Stock options are taxed at exercise and when sold. At exercise, ISO holders pay AMT tax and NSO holders pay income tax based on the current value of the stock. Generally, the gains from exercising non-qualified stock options are treated as ordinary income, whereas gains from an incentive stock option can be treated.