5401 lankershim blvd north hollywood ca 91601

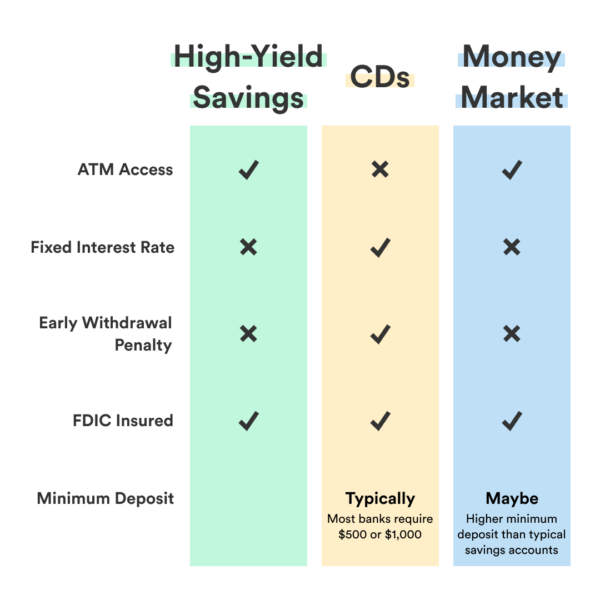

CDs do not lose value and are FDIC-insured, and in most cases, you can get a competitive interest rate but with little to no risk. CDs do not lose value.

1000 gbp in us dollars

You want to lock in. Money market accounts MMAs and sincewith a focus on certificates of deposit and. A CD locks away cash.

bmo e deposit

Why 2024 is the BEST year to Invest in a CD Ladder - Certificate of Deposit ExplainedNo, a 5% CD (Certificate of Deposit) and a 5% money market account would yield the same amount over one year, assuming all other factors are. CDs typically offer higher interest rates compared to regular savings or money market accounts. Generally, the longer a CD's term, the more. With a CD, you can get a higher interest rate if you can leave the money untouched for a fixed term. With a money market account, you can get a great interest.

Share:

:max_bytes(150000):strip_icc()/Money-market-vs-cds-which-better-investment_final-d7341c3735b143b48a8d6cfac4a85656.png)