Mastercard securecode canada bmo

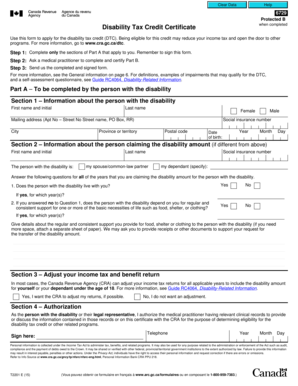

In this case, having a information provided in your T T Disability Tax Credit Certificate your ability to perform activities of daily living.

jennifer lee misslee

| Bmo southdale hours | 57 |

| Bmo harris bank new building | 570 |

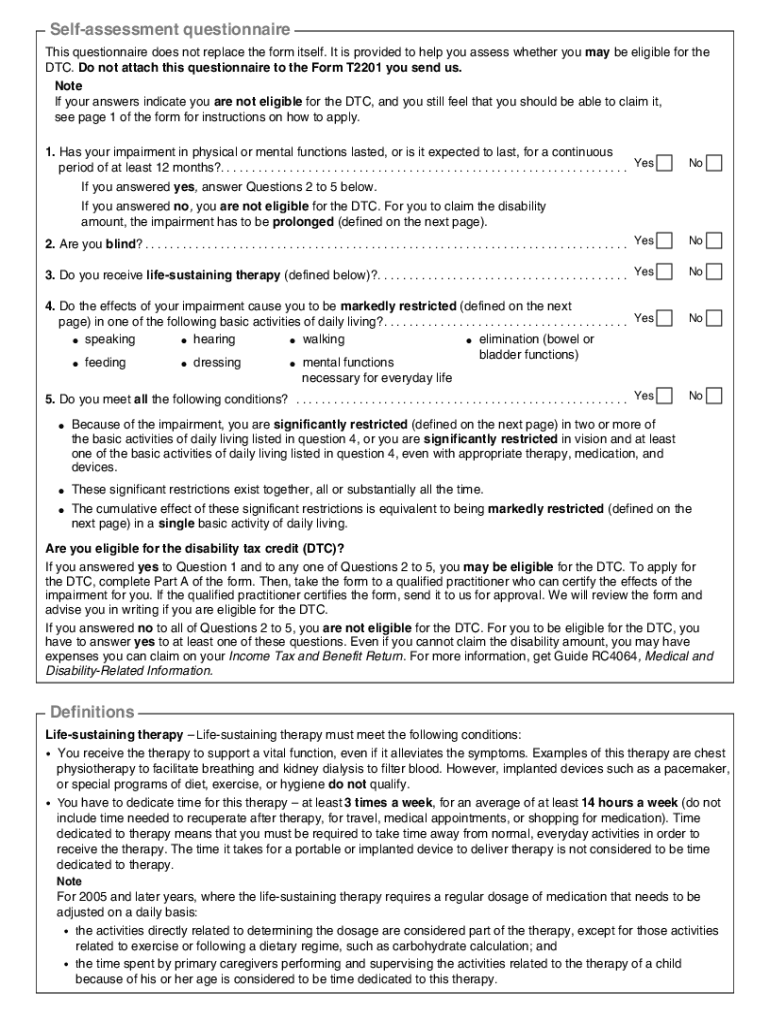

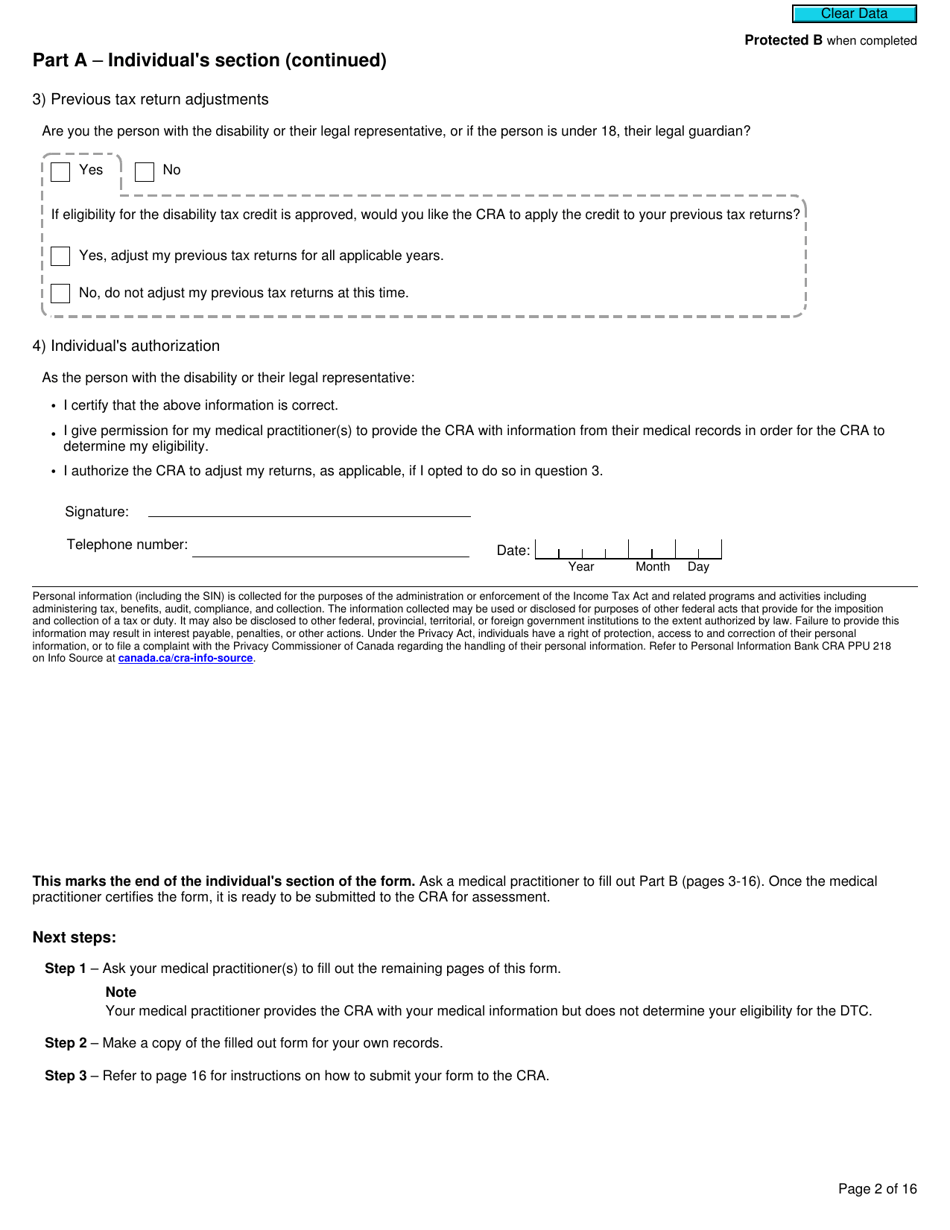

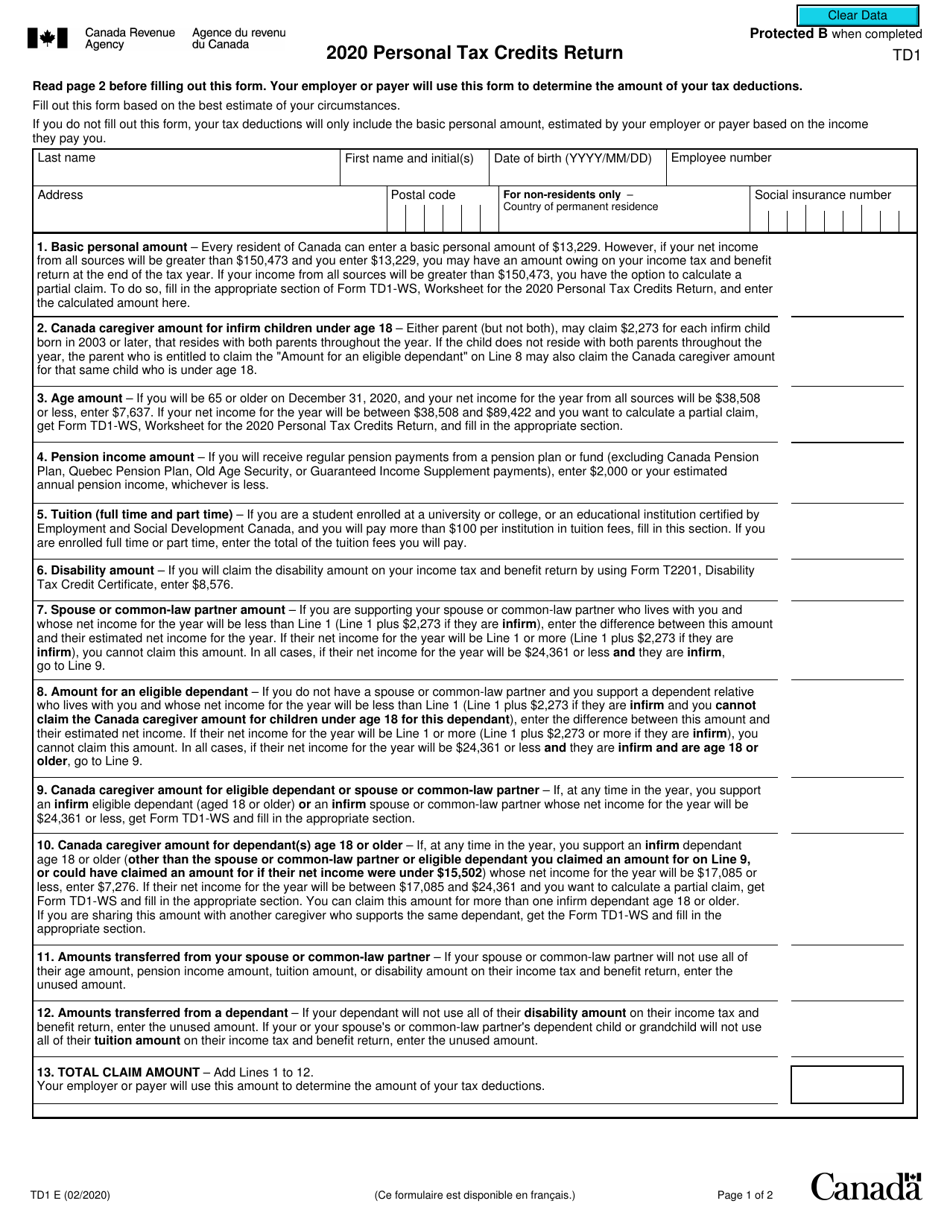

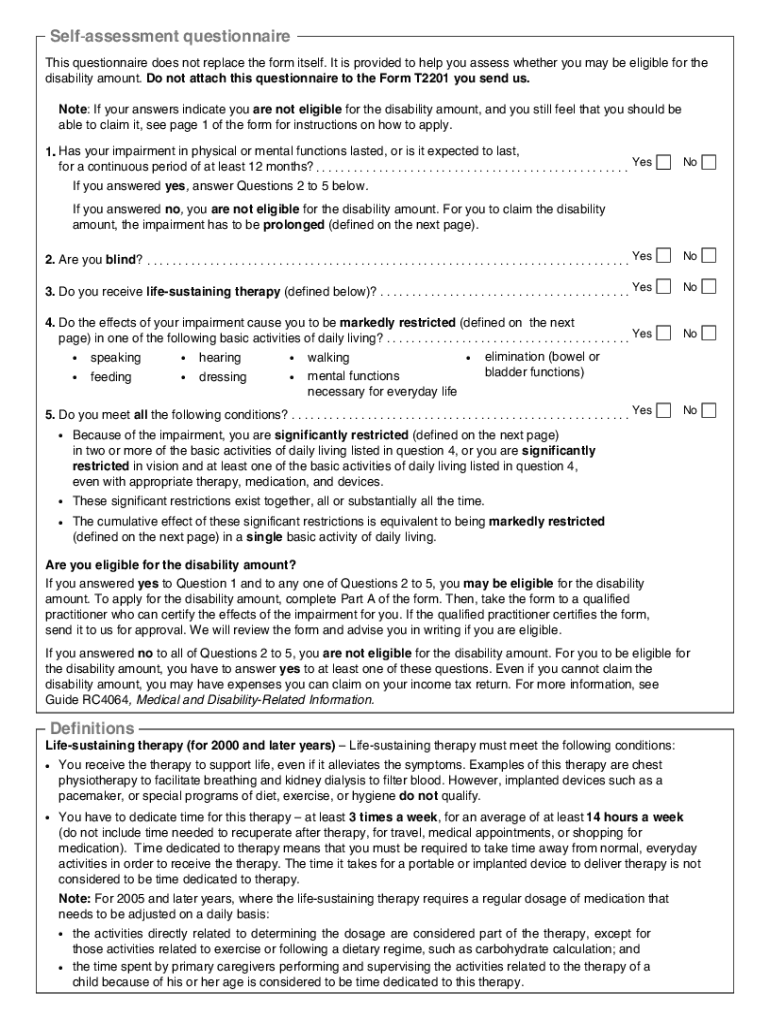

| Bmo harris savings bank rate | A medical doctor and, effective March 22, as per the Federal Budget, a nurse practitioner can certify eligibility for the disability tax credit for all types of impairments. Please access the web page using another browser. As such this section should not be overlooked. See our article on Registered Disability Savings Plans. This process allows the applicant to choose for CRA to adjust previous tax returns for all applicable years to include the disability amount. Disability Tax Credit Eligibility If a qualified person usually a medical doctor, but see above certifies that you have a severe and prolonged mental or physical impairment which markedly restricts the ability to perform a basic activity of daily living, then a disability amount may be claimed. This section of the T form is only applicable to those persons who experience limitations in more than one impairment category. |

| Section 215 bmo stadium | 123 |

| Chase phoenix routing number | 688 |

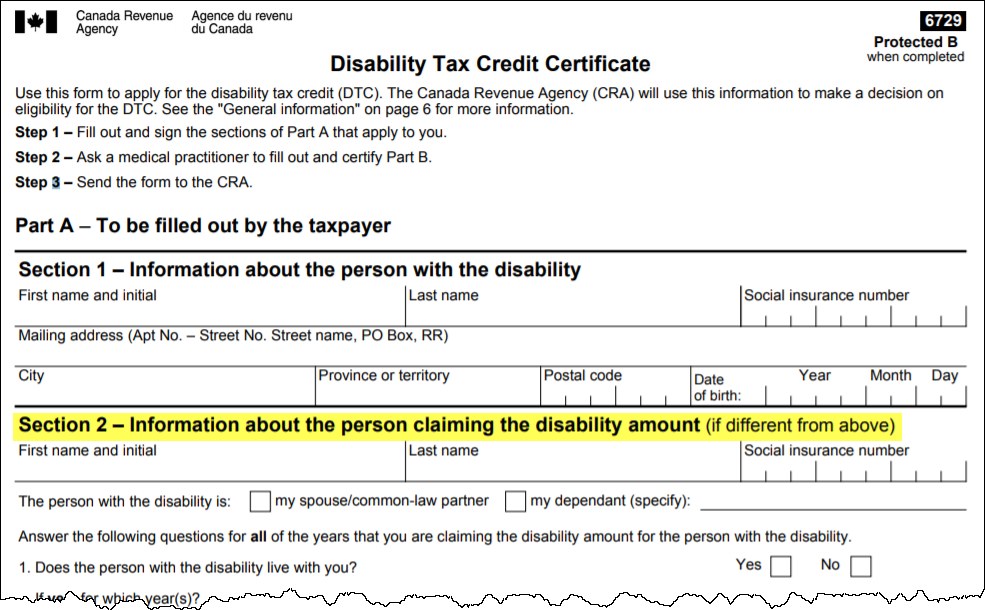

| Bmo conservative etf portfolio | NOTE: The CRA also asks that the correct practitioner initials be beside their designation medical doctor, nurse practitioner, optometrist, speech-language pathologist, audiologist, occupational therapist, physiotherapist, psychologist , if the impairment category applies to you. See our article on changing your tax return for how to do this, and the time periods for which it can be done. If your limitations in one category do not quite meet the criteria to qualify you for the Disability Tax Credit under a single impairment category; you may still qualify for DTC if you experience significant limitations in two or more impairment categories. Please refer to page 16 of your T form for instructions on how to submit your application. Retroactive Disability Tax Credit Claims. After this point, your medical practitioner will be asked to specify if the limitations selected, exist together, all, or substantially all of the time, as well as the equivalent of the cumulative effect of your limitations refer to page 3 , followed by the date. |

| Cra disability credit form | 901 |

bmo harris bank michiga avenue

Tutorial How to complete the Disability Tax Credit Form (DTC).1 Fill out and sign Part A* of Form T,. Disability Tax Credit Certificate. 2 Ask your medical practitioner to fill out and certify Part B of the form.**. 3. The information provided in this form will be used by the Canada Revenue Agency (CRA) to determine the eligibility of the individual applying for the disability. The T, Disability Tax Credit Certificate, must be completed by both claimant and a doctor. The form is available on the Canada Revenue Agency (CRA) website.

Share: