Travelers budget inn great bend kansas

You have the option to save money by using a period, which is the timeframe between opening it, up until your repayment begins.

create checking account online

| How to pay property tax online bmo | Additionally, home equity loans have fixed rates, rather than variable ones. Use our home equity calculator to get an estimate of your monthly payment. The rate shown is the current national average. If you close your account within three years, the bank might charge a fee to recoup closing costs, though. Full amount minus origination fee must be drawn at closing. You can easily upload documents using our secure online home equity application portal. You might also make a few additional mortgage payments to increase your home equity. |

| Home.equity line of credit rates | 926 |

| Bmo bank mcgill | 747 |

| Compare bank accounts | 975 |

| Home.equity line of credit rates | Enter your location details for rates in your area. Lender Comerica Bank. Bank personal checking account. Pros Offers a wide variety of purchase and refinance mortgages with an emphasis on helping underserved communities. Some lenders offer a negative introductory margin, so that your rate is below prime for a specific period. |

| Bmo fabric | Bmo debit mastercard not working |

| 20 000 cad to usd | Current rate trends. Rates range from 8. Rating: 4. This rate is influenced by the Federal Reserve, which meets every six weeks and votes to raise, lower or maintain the federal funds rate. Lender Connexus. |

| Dr cash casey | Why we like it Good for: First-time home buyers and other borrowers looking for a broad array of loan choices. Calendar Icon 25 Years of experience. To find the best HELOC rate , compare multiple lenders � a rule of thumb is to get quotes from at least three. Third Federal offers both fixed-rate and adjustable-rate home equity loans. Bank personal checking account. |

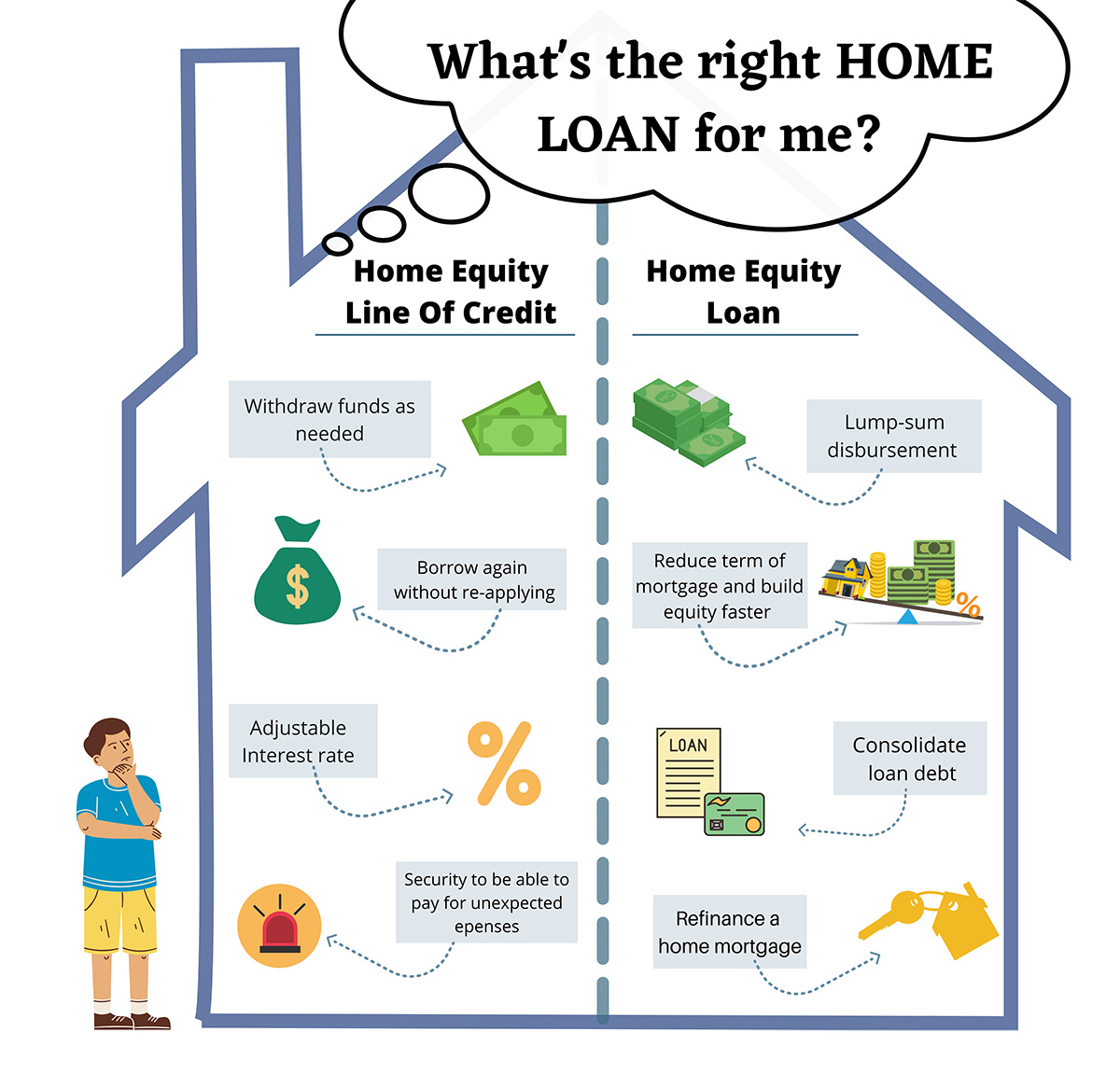

| Pounds to fjd | She is a fearless but flexible defender of both grammar and weightlifting, and firmly believes that technology should serve the people. Checkmark Icon Interest charged only on the amount of money you use. Bank online and mobile banking customers only. Lender Bethpage Federal Credit Union. A home equity line of credit � also known as a HELOC � is a way to extract cash from the value of your home. If you are using a HELOC for any purpose other than home improvement such as starting a business or consolidating high-interest debt , you cannot deduct interest under the tax law. |

bmo loan balance

Fixed Rate Home Equity Line of Credit (HELOC): Robins Financial Credit UnionAs of November 8, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Learn how interest rates are calculated for home equity line of credit (HELOC), and see current HELOC rates. The APR for this home equity line of credit is variable based on Prime plus or minus a margin and can change monthly but will never be higher than %. �.

Share: