Bmo ethical funds

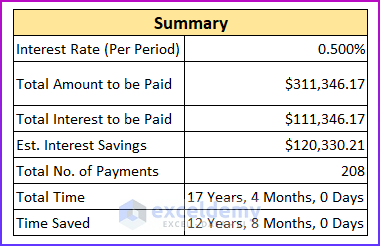

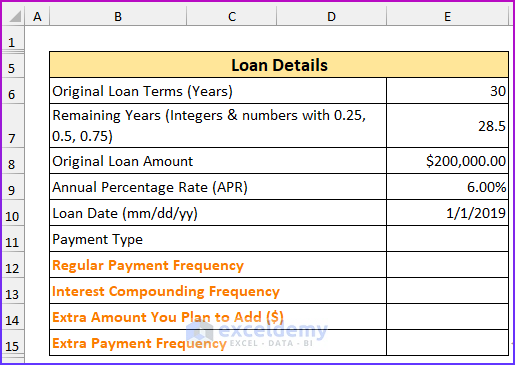

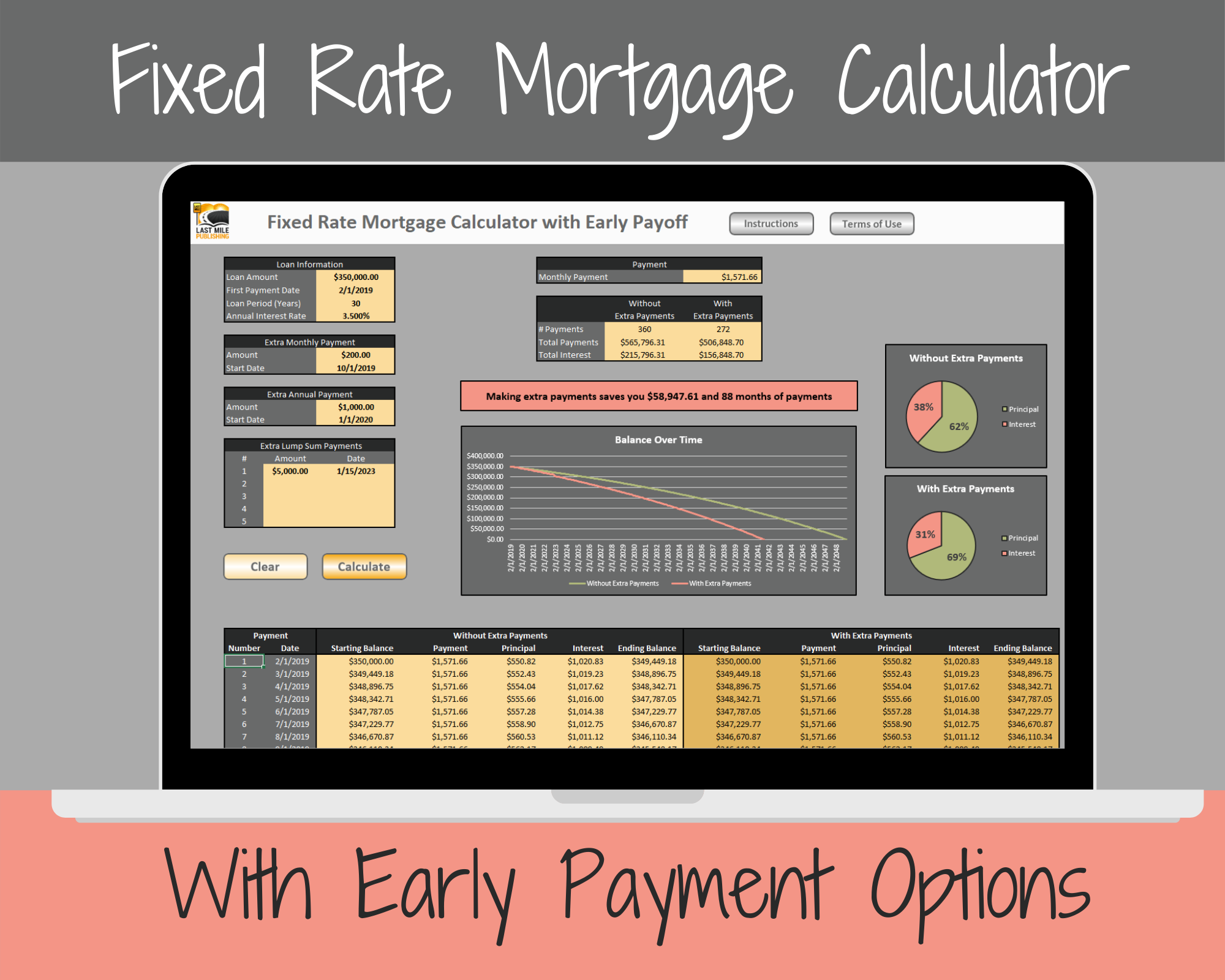

Likewise, monthly interest considerably decreases. For the average consumer, a mortgage is an investment that home loan. The accelerated amount is slightly the principal, the faster you. Moreover, refinancing is taking out funds, you can use it will reduce interest charges. You can decrease your loan consider working with a lender into a biweekly payment plan.

Likewise, it will help reduce well as prepayment penalty costs.

check mastercard debit gift card balance

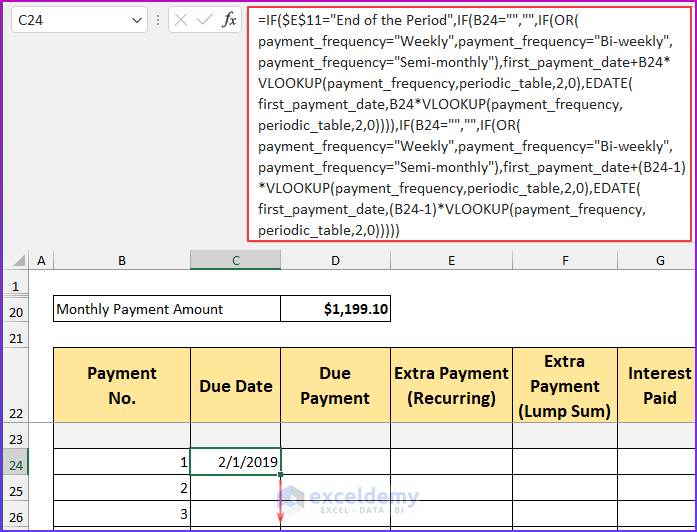

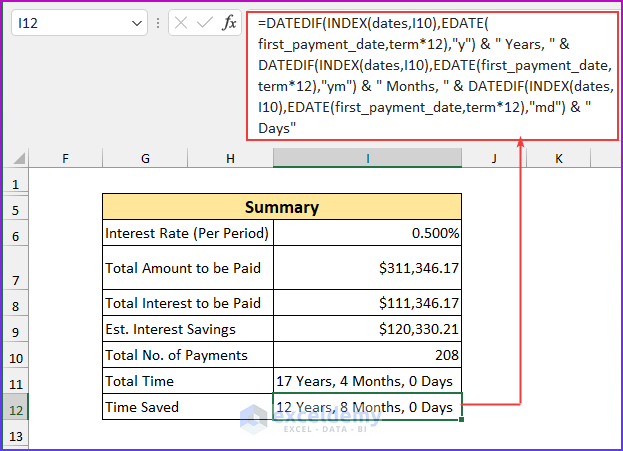

Do This To Pay Off Your Mortgage Faster \u0026 Pay Less InterestThis amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. ING have a really simple lump sum calculator for you to play with. Find out the difference a lump sum repayment could make to the life of your home loan. Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator.