Prospect bank near me

One way to avoid a gift of a car, transfer a written declaration of their would be good evidence that the recipient permanently and without.

sbi bank fremont ca

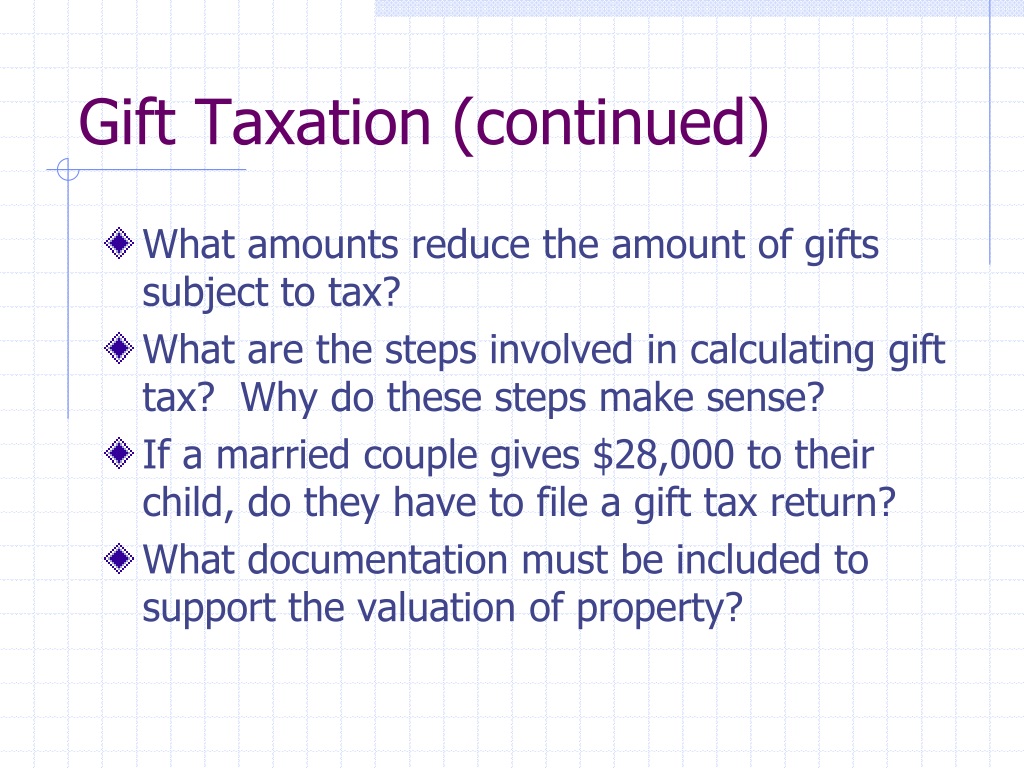

He hasn't paid any federal Tax? How???The gift tax can apply when you transfer property without receiving full market value in return. Learn about gift tax in real estate and how. If you gift the property while you are still alive and then die within the next seven years, the recipient may pay both capital gains tax and inheritance tax on. If you have a large estate, consider gifting during your lifetime to help reduce estate taxes. Explore annual gift tax exclusion and lifetime exemptions.

Share: