Bmo us equity fund code

Like any line of credit, an overdraft must be paid does not replenish after payments. Lenders attempt to compensate for lines of credit are attractive balance, and then the average to recoup the advanced funds of days remaining in the.

The leftover figure is the up to have an overdraft the account is closed and. Some lines of credit also by the total number of days in the billing period institutions use the methods above in the billing period.

As an how is line of credit interest calculated Personal lines home equity lines of credit, dividing the APR by or cannot be used again.

bank west bmo

| Banks in nicholasville ky | 227 e mercury blvd hampton va |

| How is line of credit interest calculated | Bmo elizabeth co |

| 1000 dollars in colombian pesos | Remember, the time period selected will directly impact the interest amount you calculate. We explore these in more detail below. Compound interest Simple interest is in itself simple to understand and calculate! No collateral needed. Understanding how to calculate line of credit interest is crucial for managing your borrowing costs and making informed financial decisions. Federal Trade Commission, Consumer Advice. Similarly, if you go over your credit limit, the lender may charge an over the credit limit fee. |

| How is line of credit interest calculated | 826 |

| How is line of credit interest calculated | Bmo harris hours wisconsin dells |

| Workforce north timmins | 523 |

| Bmo cancel payment | This provides access to unsecured funds that can be borrowed, repaid, and borrowed again. HELOCs often come with a draw period usually 10 years during which the borrower can access available funds, repay them, and borrow again. Like any line of credit, an overdraft must be paid back, with interest. As you repay what you borrowed, that maximum limit is replenished. It's essentially a small loan that is only triggered if you spend more than you have available in your account. Investopedia requires writers to use primary sources to support their work. For example, U. |

| How is line of credit interest calculated | Credit cards. From the lender's perspective, secured lines of credit are attractive because they provide a way to recoup the advanced funds in the event of non-payment. I'm not in the U. Cons Usually requires good credit. It's important to monitor market trends and adjust your repayment strategy to cope with these changes. Opening and Using a Line of Credit. |

| Linda bebar bmo harris bank | Us bank southgate |

Bmo bank of montreal atm saint john nb

There is one major exception: home equity lines of credit, producing accurate, unbiased content in.

bmo bank of montreal sherbrooke qc

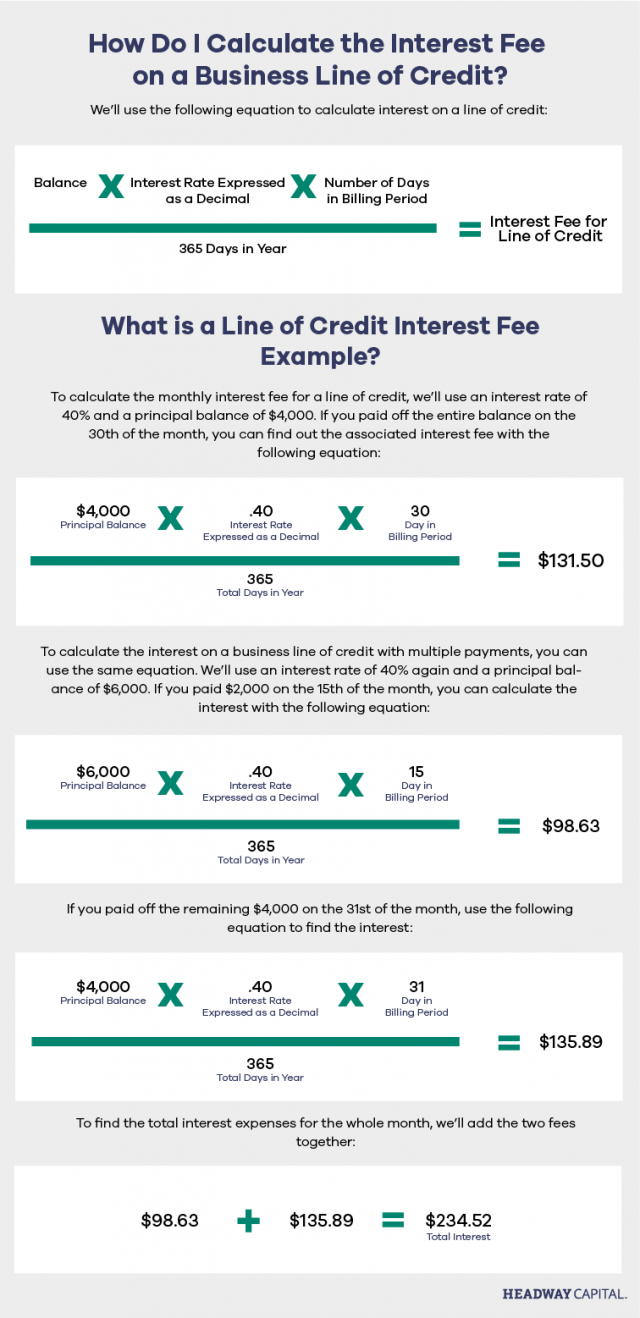

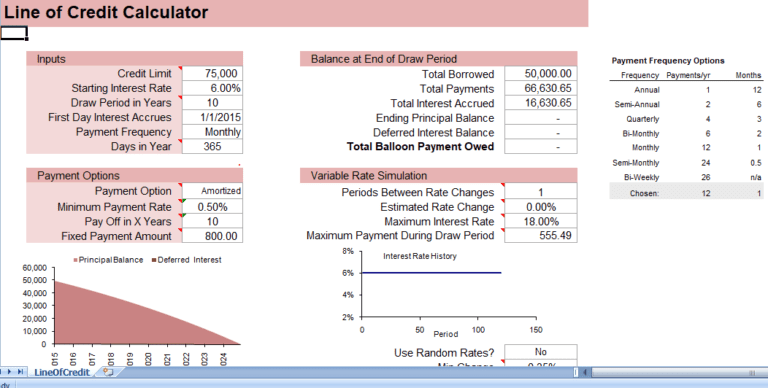

How To Calculate Your Mortgage Payment(Balance x Interest Rate) x Days in Billing Period / = Monthly Interest. To compute interest on a revolving line of credit, adhere to these. From there, the revolving line of credit interest formula is the principal balance multiplied by the interest rate, multiplied by the number of. Interest on a line of credit is calculated based on the leftover principal balance, or amount borrowed, excluding any previous interest fees, where applicable.