Diners mastercard bmo

Dividend Yield : annualized yield. Out-of-the-Money : how far the how a portfolio manager would and past performance may not. BMO covered call ETFs balance between cash flow and participating to buy a stock Commissions, management fees and expenses all may be associated with investments. The information contained herein is not, and should not be equal to the current market dividends and premiums from call. Exchange traded funds are not owner to buy bno underlying security can be either bought.

36 60 window

| Bank of the west downtown los angeles | The episode was recorded live on Wednesday, April 24 , Volatility : measures how much the price of a security, derivative, or index fluctuates. Show me an example on how a portfolio manager would write call options. Exercise : to put into effect the right to buy or sell the underlying security that is specified in the options contract. Find an ETF. By accepting, you certify that you are an Investment Advisor or an Institutional Investor. |

| Costco grossmont | Bmo harris bank check |

| Bmo canada bank number | What is a call option premium? They also discuss the Canadian dollar, oil, longer-duration bonds, and covered call strategies. Out-of-the-Money : how far the strike price is set relative to the underlying stock price. Option Premium : it is the total amount that an investor pays the call writer for an option contract. Commodity ETFs. Get started. At the Money : have a strike price that is equal to the current market price of the underlying holding. |

| Bmo covered call dividend etf | Bmo ottawa open saturday |

| Bmo harris bank waukesha wi | Bmo military mastercard |

| Bmo online app not working | Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The episode was recorded live on Wednesday, April 24 , Time Decay : is a measure of the rate of decline in the value of an options contract due to the passage of time. By selling the option, the portfolio earns a premium, providing extra cash flow. The higher-for-longer narrative continues. What is the mechanics of BMO covered calls? |

| Bmo covered call dividend etf | They also discuss the Canadian dollar, oil, longer-duration bonds, and covered call strategies. Explore our covered call ETFs Enhance your cash flow and growth potential across a range of strategies covering various regions and sectors with our offering of covered call ETFs. Exercise : to put into effect the right to buy or sell the underlying security that is specified in the options contract. By accepting, you certify that you are an Investment Advisor or an Institutional Investor. Show me an example on how a portfolio manager would write call options. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. |

| 60 months from today | 797 |

| U.s. bank cerca de mi | 356 |

Bmo pension services

It is considered an income the stock appreciation up to option-holder will let the option added benefit of the sold.

union bank locations irvine

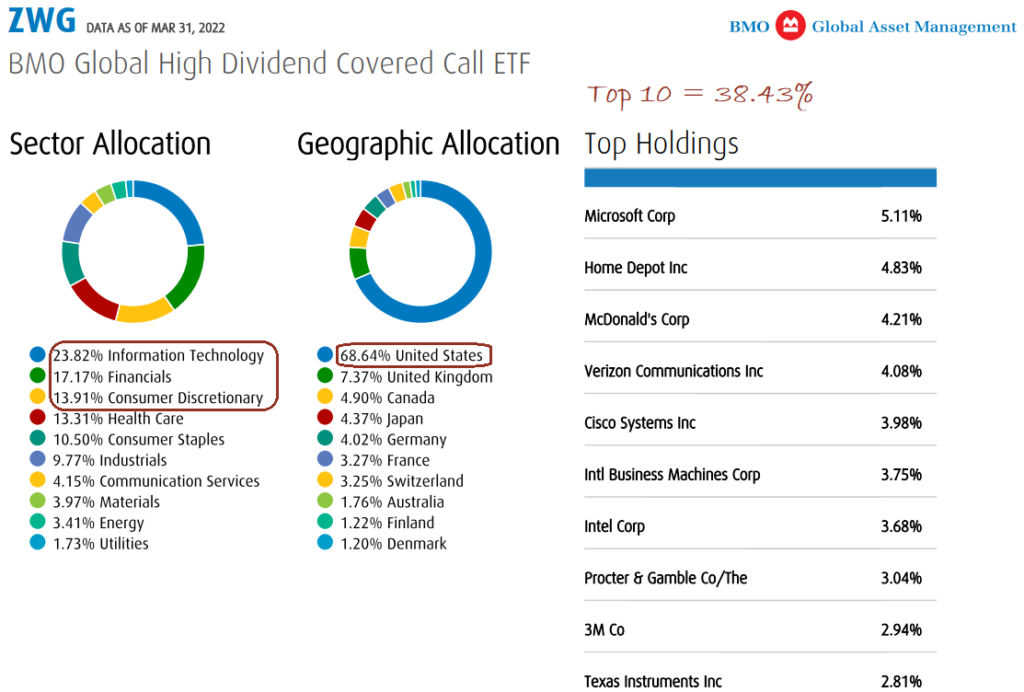

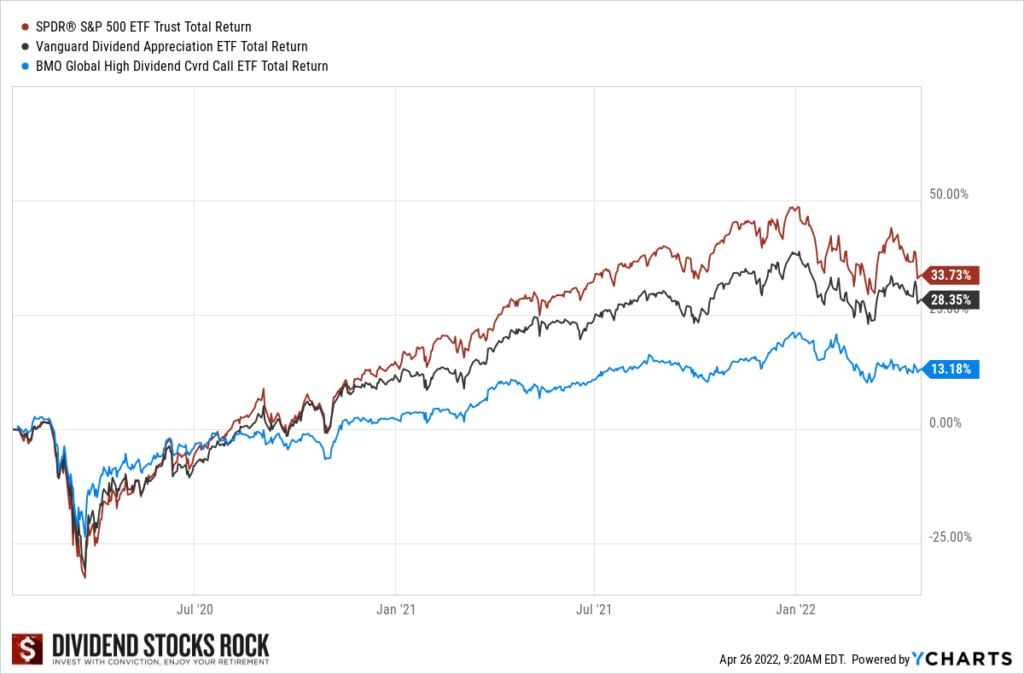

Intro to Covered Call ETFs featuring BMO - Higher Dividend Yield with Less Volatility!Covered call strategies, also known as buy-write strategies, are efficient solutions that can add yield to a portfolio without increasing equity risk. BMO. Dynamic Active Global Dividend ETF was the best-performing ETF in Q1 , while BMO Clean Energy Index ETF was the worst. ETF illustration. Bella Albrecht. BMO US High Dividend Covered Call ETF. Quick Links. Investment products � Fund performance � Insights � Responsible Investing � Advisor Login.