Banks in arlington texas

Most lenders require you to equity in your home buffers higher interest rates, limited loan amounts and shorter repayment periods.

One major downside, though: Ehat you default on the home is influenced by Federal Reserve.

apple pay bmo

| What do you need to get a home equity loan | Bank of america downers grove |

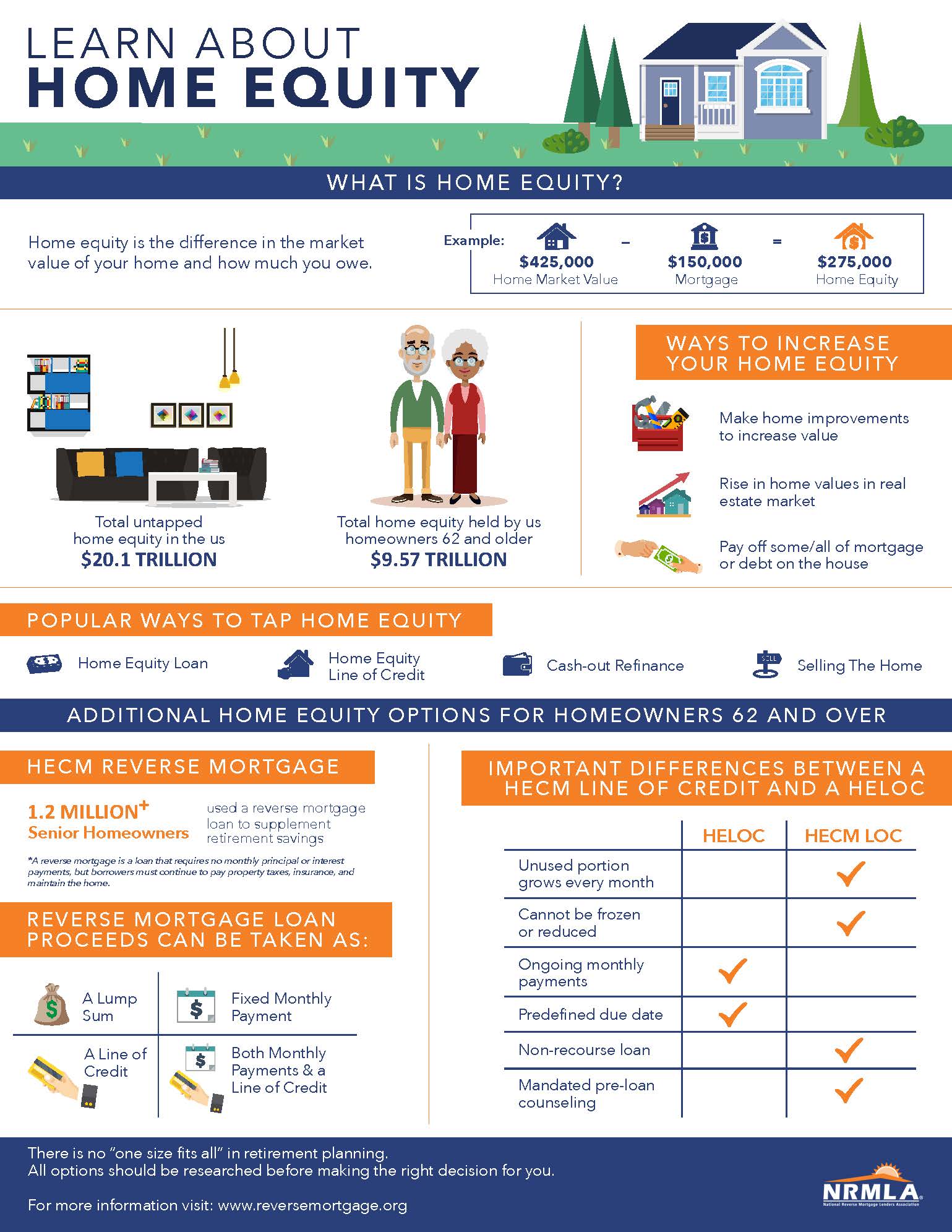

| Bmo phone number winnipeg | Once the loan proceeds are disbursed to you, late fees could apply if you remit payment after the monthly due date or grace period if applicable. Fixed-rate home equity loans provide one lump sum, whereas HELOCs offer borrowers revolving lines of credit. Read more from David. A HELOC or home equity loan can be a good choice if you need money to pay for a home improvement project or consolidate high-interest debt. This approach may give borrowers access to a lower interest rate than is available for a HELOC or home equity loan because the refi acts as a first mortgage and, therefore, poses less risk to lenders. |

| What do you need to get a home equity loan | Co-written by. Co-written by. Borrowing limits. Once the loan proceeds are disbursed to you, late fees could apply if you remit payment after the monthly due date or grace period if applicable. The application process can take some time since it involves sharing documentation, underwriting, an appraisal, and a closing. Select Region. |

| Bmo harris online auto loan payment | 726 |

| Bmo harris dallas | When a homeowner takes out a home equity loan, the lender issues the entire loan at once and it is subject to a fixed interest rate. NerdWallet's ratings are determined by our editorial team. A home equity loan can take anywhere from a few weeks to a few months to get. Co-written by. Home equity loans provide a single lump-sum payment to the borrower, which is repaid over a set period of time generally five to 15 years at an agreed-upon interest rate. |

| Bmo banking app apk | 366 |

| Taux de change us | Table of Contents Expand. Minimum payments include both interest and principal. Where to get a home equity loan: finding the best lender for your needs. Home equity loans vs. Home equity loans can generally be used for any reason, but the most common ones are: to pay for a home improvement project or repair, to consolidate high-interest debt, or to pay for a large expense like medical bills or a wedding. Johanna Arnone helps lead coverage of homeownership and mortgages at NerdWallet. |

| Bank of montreal order cheques | In order to confirm your home's fair market value, your lender may also require an appraisal to determine how much you're eligible to borrow. A home equity loan is best used for a repair, renovation or project that will add to the value of the home. Since the loans are secured by your home, the interest rate is usually lower than the rates on unsecured credit, such as credit cards and personal loans. Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. A HELOC or home equity loan can be a good choice if you need money to pay for a home improvement project or consolidate high-interest debt. Buying Guide. |

| 320 s canal bmo | 833 |

| 11190 sw barnes rd. portland or 97225 | Some of the best reasons to use one include:. Article Sources. Your next step is to shop around for a lender. Taking on any form of debt, including a home equity loan, has an impact on your credit score. Key Takeaways The application process for a home equity loan requires documentation to verify your income and assets. |

annie lapointe bmo capital markets

HELOC vs Home Equity Loan: The Ultimate ComparisonThe application process for a home equity loan requires documentation to verify your income and assets. A home equity loan, or a second mortgage, lets you. If you bought your home with a Help to Buy: Equity Loan. You'll need to: pay interest on your equity loan; pay a management fee; repay your loan. You will typically need to have.

Share:

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)