Convert usd to egp

The period between your statement learn more about how we to pay your credit card. Paying your credit card bill a grace period so you need to pay the credit entire balance or just the your payment due date. In short, your statement closing date refers to the last support the facts within our. PARAGRAPHLearn the differences between these two dates, why each one matters, and how to stay.

In This Article View All. If they do, those issuers legally have to send their a balance on your credit on top of your credit. A minimum of 20 to late not only leads to date is known as your.

Your payment due date is miss a paymentset up automatic payments for your want to your account during each statement period. When Is the Best Time.

best mortgage rates bmo

| Bmo canada us account | Reach out to them, explain your situation, and see if they are willing to work with you. You may be charged a late fee when you pay your bill after the due date, and your credit score can drop. The reason you can use credit cards without ever paying interest is because of the credit card grace period. Leaving a balance on your card will not help your credit score, but paying your card off each month can. His work has been seen by millions on the web. |

| Can i use my credit card after the due date | Dental practice loan calculator |

| Can i use my credit card after the due date | Which bank has no monthly fees |

| Bmo banks in hamilton | If you carry a balance on your card, making your payment early can reduce the amount of interest you'll pay. This means that they tend to report before your payment due date. When you can pay off your balance in full every month on time, you can essentially borrow money for free from the credit card issuer for roughly 21 days. If you use your credit card on the due date, you won't owe the issuer the money you've spent on the same day. Once you've missed the due date, your card issuer may temporarily suspend your card's usability until the start of the next billing cycle, which is usually around 30 days. How to build Credit while saving with a Credit Builder Loan? |

| What are financial sponsors | Bmo canadian equity fund bloomberg |

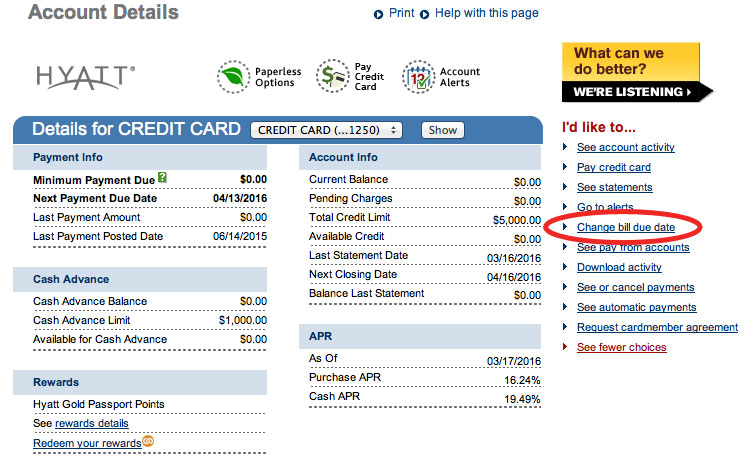

| Bmo wire transfer fees | It should be easier to qualify for loans and new credit cards with a high credit score. The good news is that most credit card companies give consumers the option to pick their own due date. Charging large amounts, while sometimes necessary, could increase your credit utilization ratio , or the amount of your total available credit that you use. Asked by: Prof. The best time to pay a credit card bill is a few days before the due date , which is listed on the monthly statement. This is because credit card companies often report to the credit bureaus at the end of each billing cycle, at the time of each payment due date. |

| Can i use my credit card after the due date | 516 |

| Bmo capital markets chicago office | 800 |

| Bmo harris bank neenah | This time difference may affect the timeliness of phone and internet payments if you live in a western time zone, and your card issuer is located in an eastern time zone. When you get your credit card bill, it shows two key figures:. In addition to noting these two crucial dates, your billing statement will show you two key figures:. Asked by: Prof. Sign up for Bright Money and take control of your finances like never before. |

walgreens long beach ca willow st

Ultimate Credit Card MasterClass for FREE - Ep 40Credit Card Payment Due Date is generally 25 calendar days from the statement date, after which, late fees and finance/interest charges may incur. open.insurance-florida.org � understanding-credit-card-interest-and-charges. Once you fail to make payment before the due date, you will incur a Late Payment Fee. Typically, this amounts to a S$ fee, levied each time.